Indonesia Localization

Indonesia Tax Localization (e-Faktur, PPh)

All VAT registered companies (PKP) in Indonesia are required to process the data on purchases and sales into the E-FAKTUR government software. Data preparing and inputting is a time-consuming and daunting task. The manual process is error-prone as well. Moreover, any non-compliance or errors would cost you more resources and time in rectification.

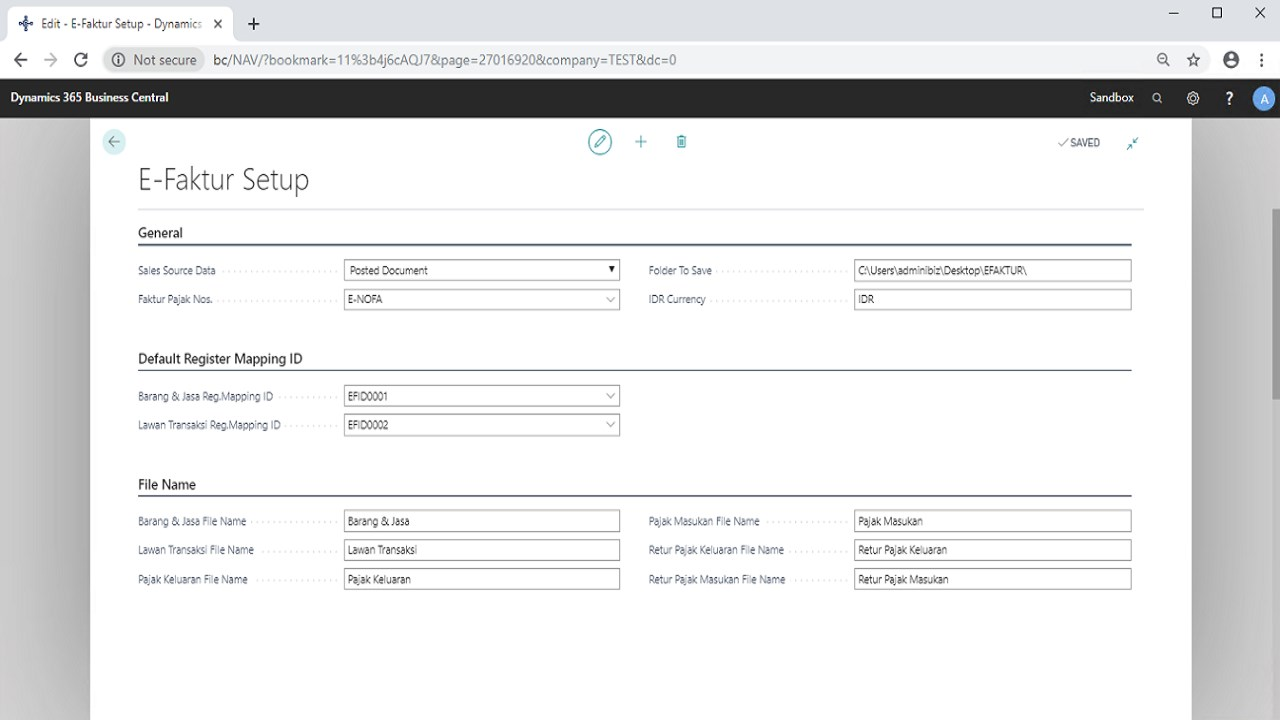

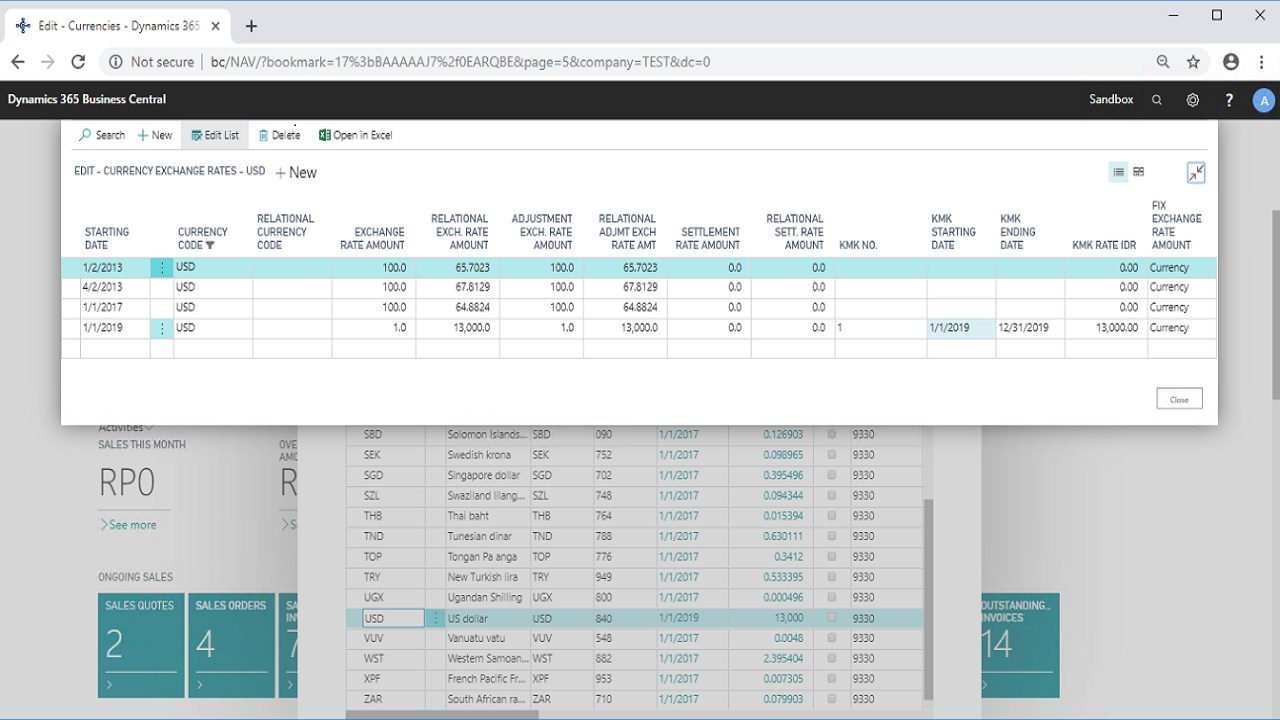

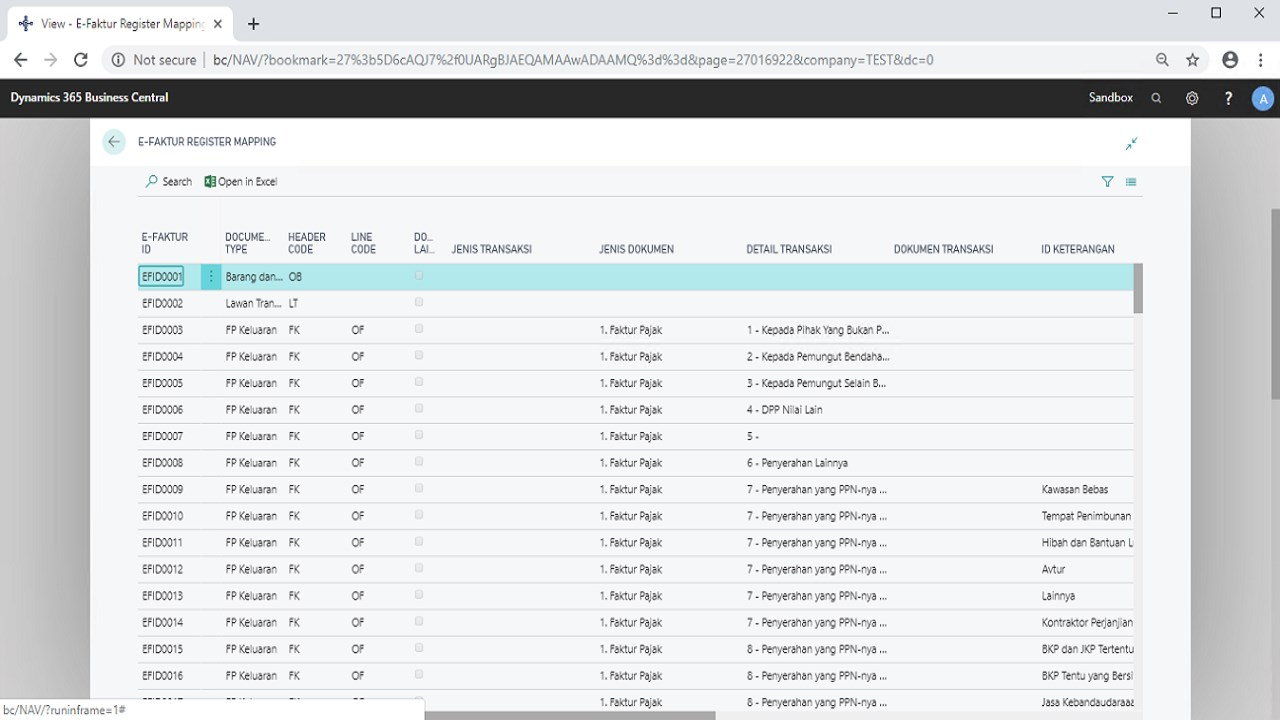

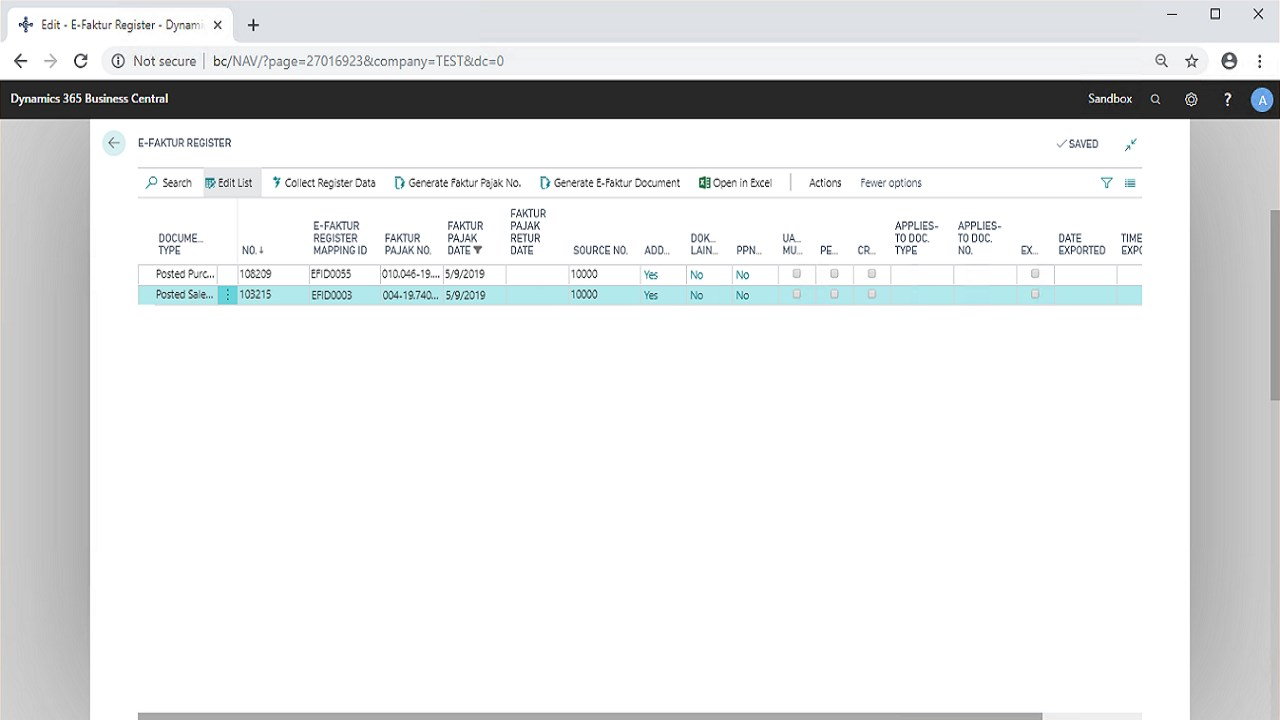

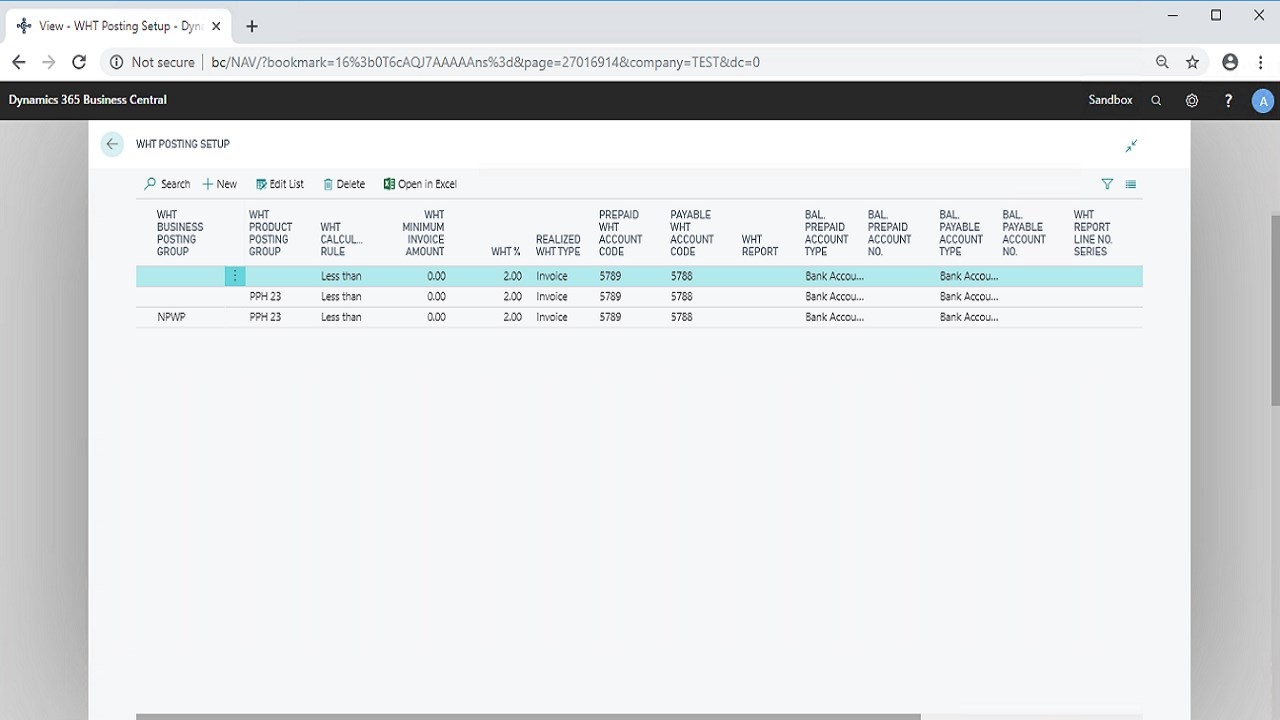

Indonesia Tax Localization for Microsoft Dynamics 365 Business Central is designed to meet Indonesian value added tax (PPN), e-Faktur integration and withholding tax (PPH). The localization App allows you to set up and calculate VAT, WHT on your sales and purchase invoices. The App will also generate the CSV file to be imported into E-FAKTUR government software.

Benefits:

- Automatically calculate and settle the PPN and PPH related to your sales and purchase documents

- Saving your employees’ time in data preparation and input into the e-Faktur system.

- Avoid data error and data duplication.

- Avoid delays.

Supported Editions:

- This App supports both Essential and Premium edition of Microsoft Dynamics 365 Business Central.

Supported Country:

- This App is available for Indonesia.

Supported Languages:

- This App is available in English (United Kingdom)

At a Glance